Understanding The Significance Of Invoice FOB In Business Transactions

In the dynamic world of international trade, the term "invoice FOB" holds significant importance for businesses engaged in the buying and selling of goods. This acronym, which stands for "Free on Board," defines the terms and conditions under which goods are transported, sold, and invoiced. As companies navigate the complexities of global commerce, understanding the intricacies of invoice FOB becomes crucial for effective financial management and risk assessment.

When dealing with invoice FOB, it's essential to grasp the impact it has on cost allocation and liability during the shipping process. Businesses need to ensure clarity regarding who bears the responsibility for shipping costs and risks at various stages of the transaction. This article aims to demystify the concept of invoice FOB, providing insights into its implications for both buyers and sellers in international trade.

Moreover, as the world becomes increasingly interconnected, the knowledge of invoice FOB can streamline operations and foster better relationships between trading partners. Whether you are a seasoned trader or new to the world of international commerce, understanding invoice FOB is a vital component of successful trade practices. Let's dive deeper into this essential topic.

What is Invoice FOB?

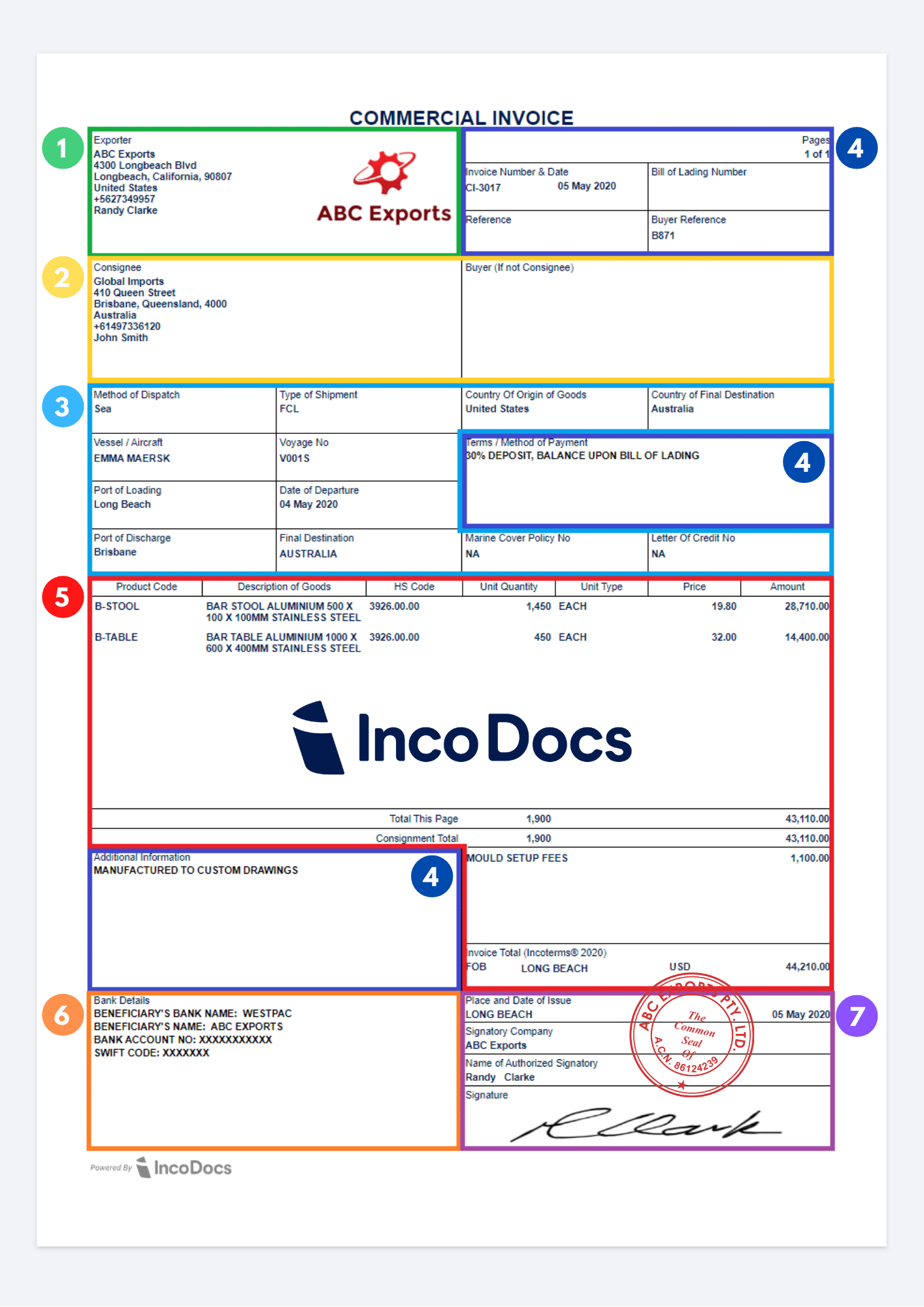

Invoice FOB refers to a shipping term used in international trade that signifies the point at which the responsibility for goods transfers from the seller to the buyer. Under FOB terms, the seller is responsible for transporting the goods to a specified shipping point, where the buyer assumes responsibility for the goods. This arrangement can vary depending on the specific terms agreed upon in the invoice.

How Does Invoice FOB Work in International Trade?

The operation of invoice FOB involves several key components that dictate how goods are shipped and invoiced. Here’s a breakdown of the process:

- The seller prepares the goods for shipment and covers the associated costs until the goods reach the designated shipping point.

- Once the goods are loaded onto the shipping vessel, the buyer assumes responsibility for the goods, including transportation costs and any associated risks.

- The invoice issued will reflect these terms, stating clearly the FOB point and any relevant shipping details.

What are the Key Benefits of Using Invoice FOB?

Using invoice FOB offers several advantages for both buyers and sellers:

- Cost Clarity: Clearly defines who is responsible for shipping costs, reducing potential disputes.

- Risk Management: Helps manage risk by specifying when the liability for goods transfers.

- Customs Compliance: Simplifies customs procedures by providing clear documentation of ownership transfer.

What Should You Include in an Invoice FOB?

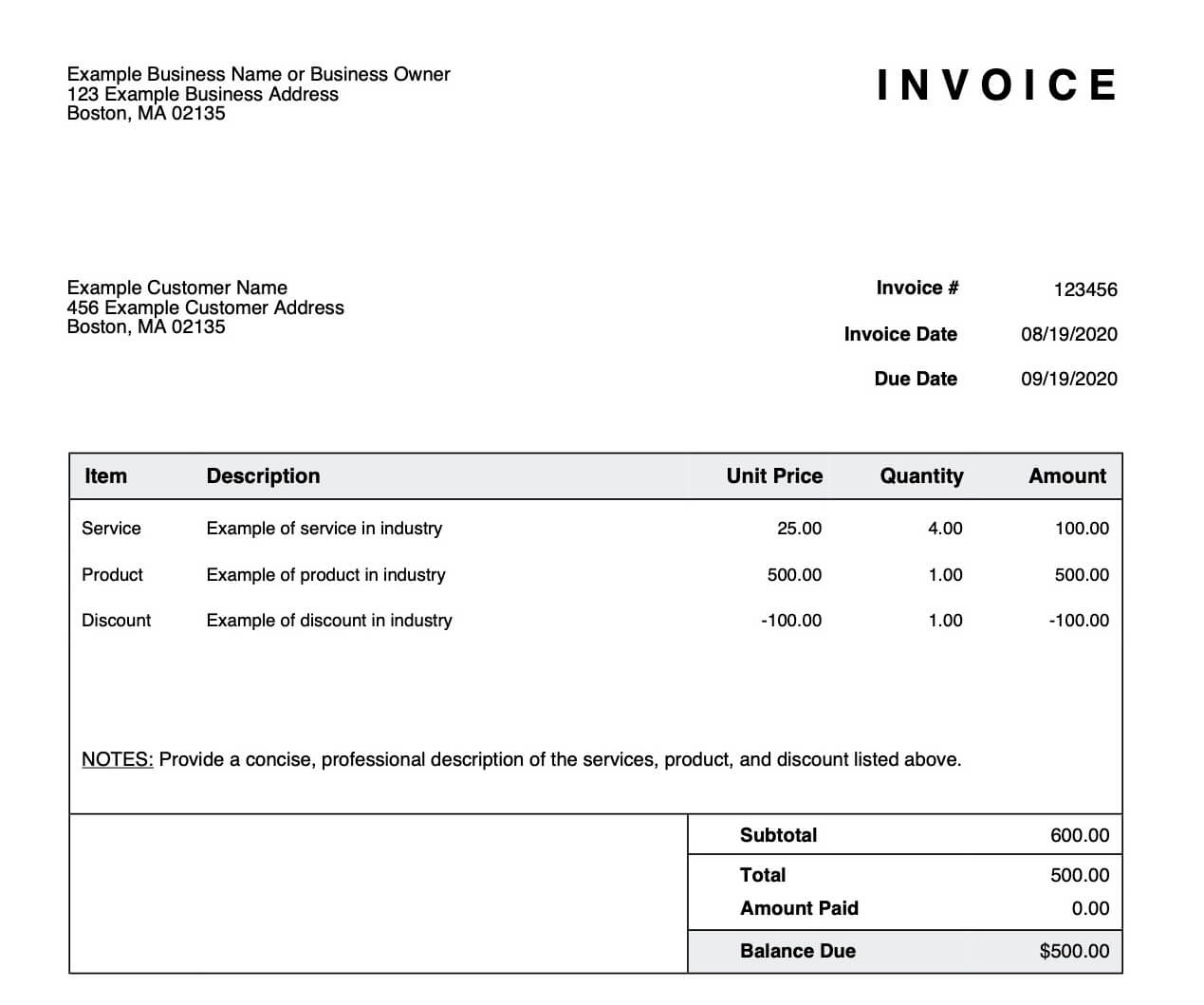

When crafting an invoice FOB, it's vital to include specific details to avoid confusion and ensure a smooth transaction. Essential elements should consist of:

- Invoice number and date

- Seller's and buyer's contact information

- Description of the goods being shipped

- FOB shipping point

- Shipping costs and payment terms

What Are Common Mistakes to Avoid with Invoice FOB?

While utilizing invoice FOB, certain pitfalls can be detrimental to the transaction. Here are common mistakes to be wary of:

- Not clearly defining the FOB shipping point, which can lead to disputes over responsibility.

- Failing to include all shipping and handling costs in the invoice, causing unexpected expenses for the buyer.

- Not verifying the accuracy of shipping documents, which can complicate customs clearance.

How Can You Improve Your Use of Invoice FOB?

Improving the effectiveness of invoice FOB requires consistent evaluation and adjustment of your processes. Some strategies include:

- Regularly reviewing and updating shipping contracts to align with current practices.

- Enhancing communication with trading partners to clarify responsibilities and expectations.

- Investing in training for staff involved in logistics and invoicing to ensure compliance with FOB terms.

Conclusion: The Importance of Mastering Invoice FOB

In conclusion, understanding invoice FOB is essential for anyone engaged in international trade. By grasping the nuances of this term, businesses can effectively manage costs, mitigate risks, and foster better relationships with clients and suppliers. As the global marketplace continues to evolve, mastering invoice FOB will not only enhance operational efficiency but also contribute to the long-term success of trading enterprises. Embracing this knowledge is a step towards thriving in the competitive world of international business.

ncG1vNJzZmixn6PAtr7IZqWeq6RjsLC5jq2pnqaUnruogY6ipa%2BnmZiybrLOm2WhrJ2h