Understanding The Importance Of Reviewing Fixed And Variable Costs During The Budget

In the world of personal finance and business management, the significance of budgeting cannot be overstated. A well-prepared budget serves as a roadmap, guiding you through your financial journey. However, it’s a good idea to review fixed and variable costs during the budget planning process to ensure that you are making informed decisions. Understanding these costs not only helps in tracking expenses but also aids in identifying areas where savings can be made.

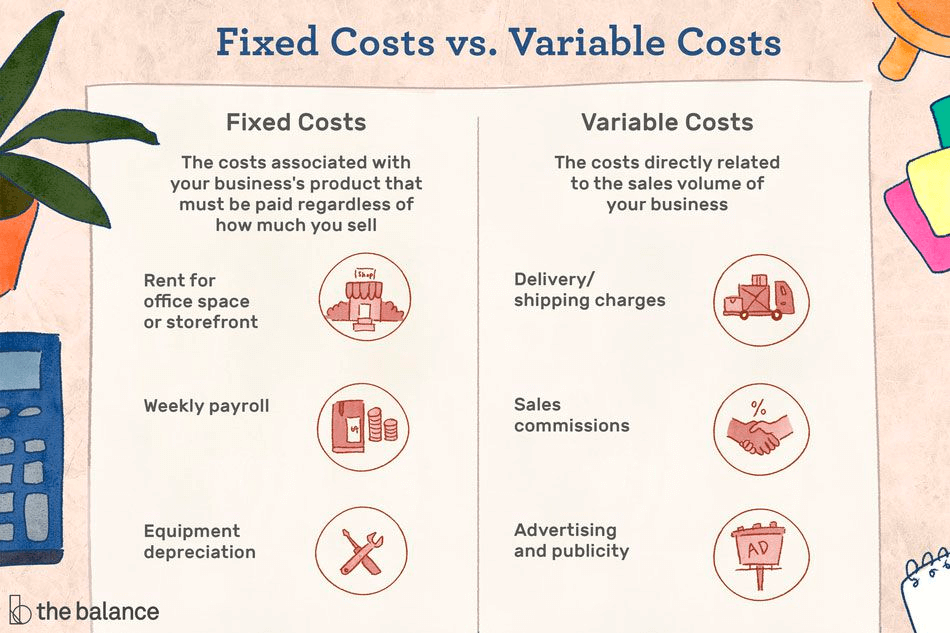

Fixed costs, which remain constant regardless of production or sales levels, include expenses like rent, salaries, and insurance. On the other hand, variable costs fluctuate based on business activity and can include costs like materials, utilities, and commissions. By distinguishing between these two types of costs, individuals and organizations can better allocate resources and plan for future financial needs.

In this article, we will delve deeper into why it’s a good idea to review fixed and variable costs during the budget. We will explore various aspects, including how this analysis can lead to better financial health, the steps involved in reviewing these costs, and tips on optimizing your budget. Whether you are managing a personal budget or overseeing a corporate financial plan, understanding these costs is crucial for achieving your financial goals.

What Are Fixed Costs?

Fixed costs are expenses that do not change with the level of goods or services produced by a business. They are regular and predictable, making them easier to incorporate into a budget. Common examples include:

- Rent or mortgage payments

- Salaries of permanent employees

- Insurance premiums

- Depreciation on assets

Why Are Fixed Costs Important in Budgeting?

Understanding fixed costs is essential for several reasons:

- They help in establishing a baseline for budgeting.

- They aid in long-term financial planning.

- They can assist in identifying areas for cost-cutting.

How Can You Manage Fixed Costs Effectively?

To manage fixed costs effectively, consider the following strategies:

- Negotiate rent or leasing terms to lower payments.

- Review insurance policies to ensure you are getting the best rates.

- Evaluate staffing needs to avoid overstaffing and associated costs.

What Are Variable Costs?

Variable costs, in contrast, are those that fluctuate depending on production levels or sales volume. They can vary significantly from month to month, making them a critical area to monitor in any budget. Examples of variable costs include:

- Raw materials

- Utility bills that vary with usage

- Commission payments to sales staff

Why Should You Track Variable Costs During the Budgeting Process?

Tracking variable costs is vital because:

- They can greatly impact the overall profitability of a business.

- They provide insights into operational efficiency.

- They help in forecasting future expenses based on different production levels.

What Strategies Can Help Control Variable Costs?

To effectively control variable costs, consider implementing the following strategies:

- Monitor usage and waste to minimize unnecessary expenses.

- Negotiate with suppliers for better pricing on materials.

- Utilize technology to automate processes and reduce labor costs.

How Often Should You Review Fixed and Variable Costs?

Regular reviews are essential for maintaining financial health. It’s recommended to assess fixed and variable costs at least quarterly. This practice allows you to:

- Adjust your budget based on changes in costs.

- Identify trends that may require strategic adjustments.

- Ensure ongoing alignment with financial goals.

What Tools Can Help You Review Costs Effectively?

Several tools can assist in reviewing fixed and variable costs:

- Accounting software for tracking expenses.

- Spreadsheets for manual analysis and forecasting.

- Financial dashboards for real-time monitoring of costs.

In Conclusion: Why It's a Good Idea to Review Fixed and Variable Costs During the Budget?

In summary, it’s a good idea to review fixed and variable costs during the budget to maintain financial stability and achieve your financial goals. By understanding these costs, you can make informed decisions, optimize your spending, and ultimately enhance your financial health. Regular reviews, combined with effective management strategies, will empower you to navigate the complexities of budgeting with confidence. Whether you are an individual or a business owner, this practice is essential for long-term success.

ncG1vNJzZmixn6PAtr7IZqWeq6RjsLC5jq2pnqaUnruogY6iq6xlkWK0sLvDZqCdnZFiwbB50Z6top2nYrOqxMSdZJqmlGLDor7ImpmlnV2YvLTA0mabrqqZo7RuwMeeZJutlJyytXrHraSl