The Financial Implications Of State Tax: Patrick's Initial Profit Scenario

Understanding the financial responsibilities that come with profit generation is crucial for any entrepreneur, including Patrick. As he embarks on his business journey, it's important for him to be aware of the state tax obligations that accompany his initial profit. The state tax patrick must pay on the initial profit is not just a regulatory requirement; it significantly impacts his overall financial strategy. In this article, we will delve into the specific tax obligations that Patrick faces and provide insights into effective tax management.

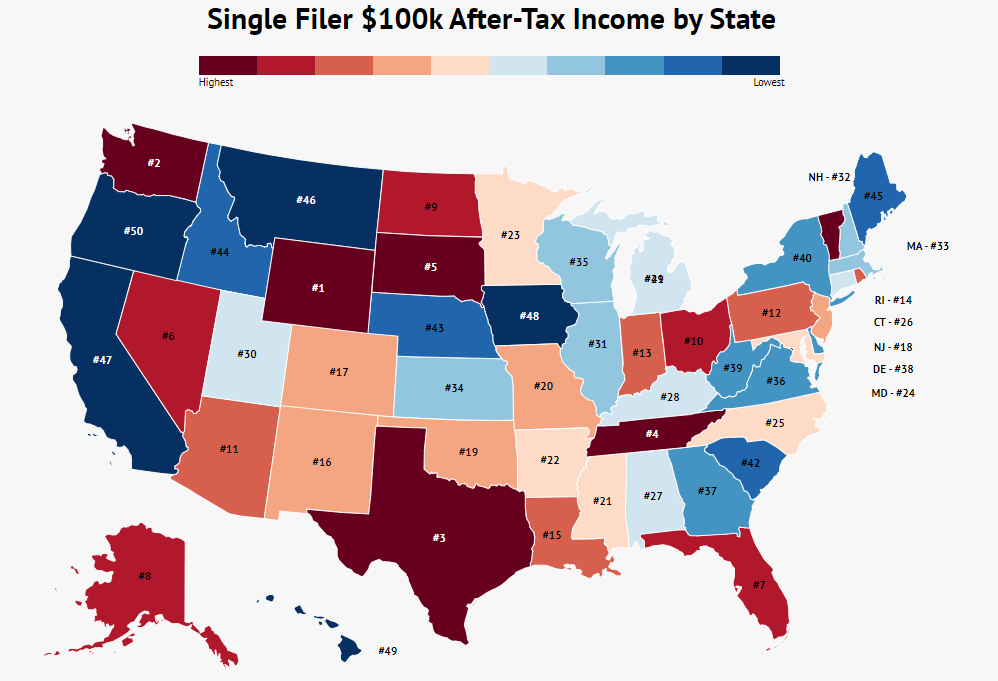

As Patrick navigates the complexities of his business, he must grasp the importance of compliance with state tax laws. Each state has its own tax regulations that dictate how much tax an individual or business must pay on profits earned. This means that the state tax patrick must pay on the initial profit is subject to variation depending on where he operates. By understanding these nuances, Patrick can better prepare for his financial responsibilities and potentially minimize his tax burden.

Additionally, it's essential for Patrick to recognize that effective tax planning can lead to significant savings. This article aims to equip him with the knowledge necessary to navigate his tax obligations confidently. From understanding the types of taxes he may encounter to exploring potential deductions, we will cover everything Patrick needs to know to manage the state tax patrick must pay on the initial profit responsibly.

What is the State Tax Patrick Must Pay on His Initial Profit?

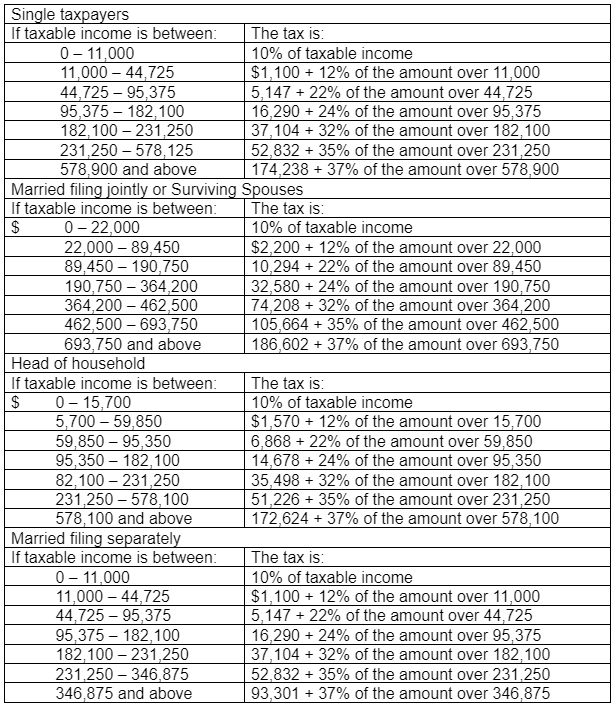

The state tax patrick must pay on the initial profit is determined by several factors, including the state's tax rate, the nature of his business, and the total amount of profit he generates. Different states have varying tax structures, with some implementing a flat tax rate while others may have progressive tax systems. Therefore, understanding the specific tax rate in his state is crucial for Patrick as he calculates his potential tax liability.

How Do State Taxes Impact Patrick's Business Profitability?

State taxes can have a significant impact on Patrick's overall business profitability. High tax rates can reduce the amount of profit that remains after taxes, affecting his ability to reinvest in the business or distribute profits to stakeholders. By understanding the state tax patrick must pay on the initial profit, he can make informed decisions about pricing, budgeting, and financial forecasting.

What Are the Different Types of State Taxes Patrick Might Encounter?

- Income Tax: This is a tax on the income generated by Patrick's business, which varies by state.

- Sales Tax: If Patrick sells products, he may need to collect sales tax from his customers.

- Property Tax: If he owns property for his business, property taxes will also apply.

- Franchise Tax: Some states impose a franchise tax on businesses operating within their borders.

How Can Patrick Calculate His State Tax Obligations?

Calculating the state tax patrick must pay on the initial profit involves several steps. First, he needs to determine his total profit for the year. This includes revenue generated from sales minus any allowable deductions. Once he has his net profit, he can apply the relevant state tax rate to calculate his tax liability.

Are There Deductions Patrick Can Use to Reduce His Tax Burden?

Yes, Patrick may be eligible for various deductions that can lower his taxable income. Common deductions include business expenses such as:

- Operational costs (utilities, rent, wages)

- Depreciation of assets

- Marketing and advertising expenses

- Travel and transportation costs

What Records Should Patrick Maintain for Tax Purposes?

To ensure compliance and make tax calculations easier, Patrick should maintain accurate records of all financial transactions. This includes:

- Sales invoices and receipts

- Expense receipts and statements

- Bank statements

- Payroll records

What Resources Are Available for Patrick to Manage His State Taxes?

Patrick does not have to navigate state taxes alone. There are numerous resources available to help him manage his tax obligations effectively. These include:

- Tax Professionals: Hiring an accountant or tax advisor can provide personalized guidance tailored to his business needs.

- Online Tax Software: Various software solutions can assist Patrick in calculating taxes and maintaining records.

- State Tax Websites: Each state has resources available online that outline tax rates, forms, and filing requirements.

What Are the Consequences of Failing to Pay State Taxes?

Failing to pay the state tax patrick must pay on the initial profit can lead to serious consequences. These may include:

- Penalties and interest on unpaid taxes

- Legal action from the state

- Damage to business reputation

How Can Patrick Stay Updated on Changes in State Tax Laws?

Tax laws can change frequently, and it is essential for Patrick to stay informed about any modifications that may affect his obligations. He can do this by:

- Subscribing to newsletters from tax professionals or financial advisors

- Joining local business associations that provide updates on tax regulations

- Consulting with his accountant regularly to discuss any changes in tax laws

In conclusion, the state tax patrick must pay on the initial profit is an important factor in his business's financial health. By understanding his obligations and utilizing available resources, he can effectively manage his tax responsibilities and focus on growing his business. Through careful planning and informed decision-making, Patrick can navigate his tax obligations confidently and ensure the long-term success of his entrepreneurial endeavors.

ncG1vNJzZmixn6PAtr7IZqWeq6RjsLC5jq2pnqaUnruogY6tn55lo6mutbGMrZixZaCWwbO1wqRkpq2jqXqxrdhmpqdlpJ2ybrXNoquimZxivbO7xaKrZqGjY7W1ucs%3D