In Full Settlement Of Each Of The Following Invoices, Assuming That Credit

In the ever-evolving landscape of business transactions, the terminology used in invoicing plays a crucial role in ensuring clarity and mutual understanding between parties. One such phrase that often surfaces in financial discussions is "in full settlement of each of the following invoices, assuming that credit." This phrase encapsulates the essence of settling outstanding debts while considering any credits that may have been applied. By exploring this concept, businesses can navigate their financial obligations more effectively, thereby fostering stronger relationships with clients and vendors alike.

Invoicing is not merely a transactional tool; it is a vital communication medium that reflects the financial health of a business. The phrase “in full settlement of each of the following invoices, assuming that credit” emphasizes the importance of transparency and accountability when it comes to managing accounts. Understanding this phrase helps businesses articulate their financial intentions clearly, minimizing the risk of disputes and misunderstandings.

Moreover, as businesses strive for efficiency and accuracy in their financial dealings, grasping the implications of such phrases becomes essential. The ability to communicate that a payment represents a full settlement ensures that all parties are on the same page regarding what is owed and what has been paid. This article delves deeper into the implications of this phrase, exploring its significance in the world of invoicing and credit management.

What Does "In Full Settlement of Each of the Following Invoices, Assuming That Credit" Mean?

This phrase essentially indicates that a payment is being made that fully satisfies the specified invoices, taking into account any credits that may reduce the total amount due. It serves as a formal acknowledgment that the payment being made addresses all outstanding balances mentioned in the invoices, thereby preventing any future claims or disputes regarding those amounts.

Why is This Phrase Important in Business Transactions?

Understanding the significance of this phrase is crucial for several reasons:

- It establishes clear communication regarding financial obligations.

- It helps prevent disputes by confirming that a payment covers all specified invoices.

- It promotes good relations between businesses and their clients or vendors.

How Can Businesses Effectively Use This Phrase?

Businesses can effectively use this phrase in their invoicing practices by following these steps:

What Are the Risks of Not Using This Phrase?

Failing to include this phrase in financial communications can lead to various complications, including:

- Misunderstandings about outstanding balances.

- Potential disputes regarding payments and credits.

- Strained relationships with clients and vendors.

How Does Credit Impact Invoice Settlement?

The role of credit in invoice settlement is pivotal. When businesses extend credit to their clients, it allows for flexibility in payment. However, it is essential to accurately reflect any credits in the invoice settlement process to prevent confusion and ensure both parties have a clear understanding of the financial transaction.

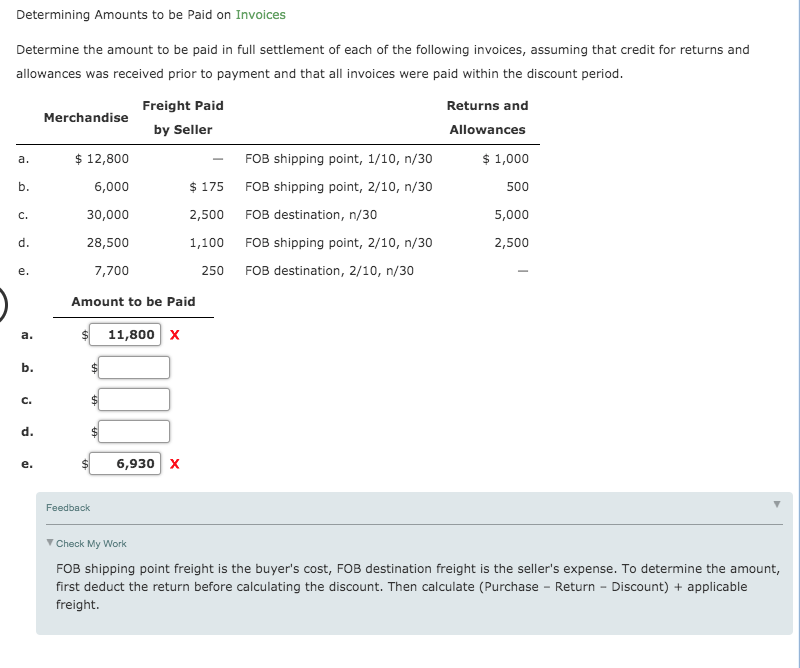

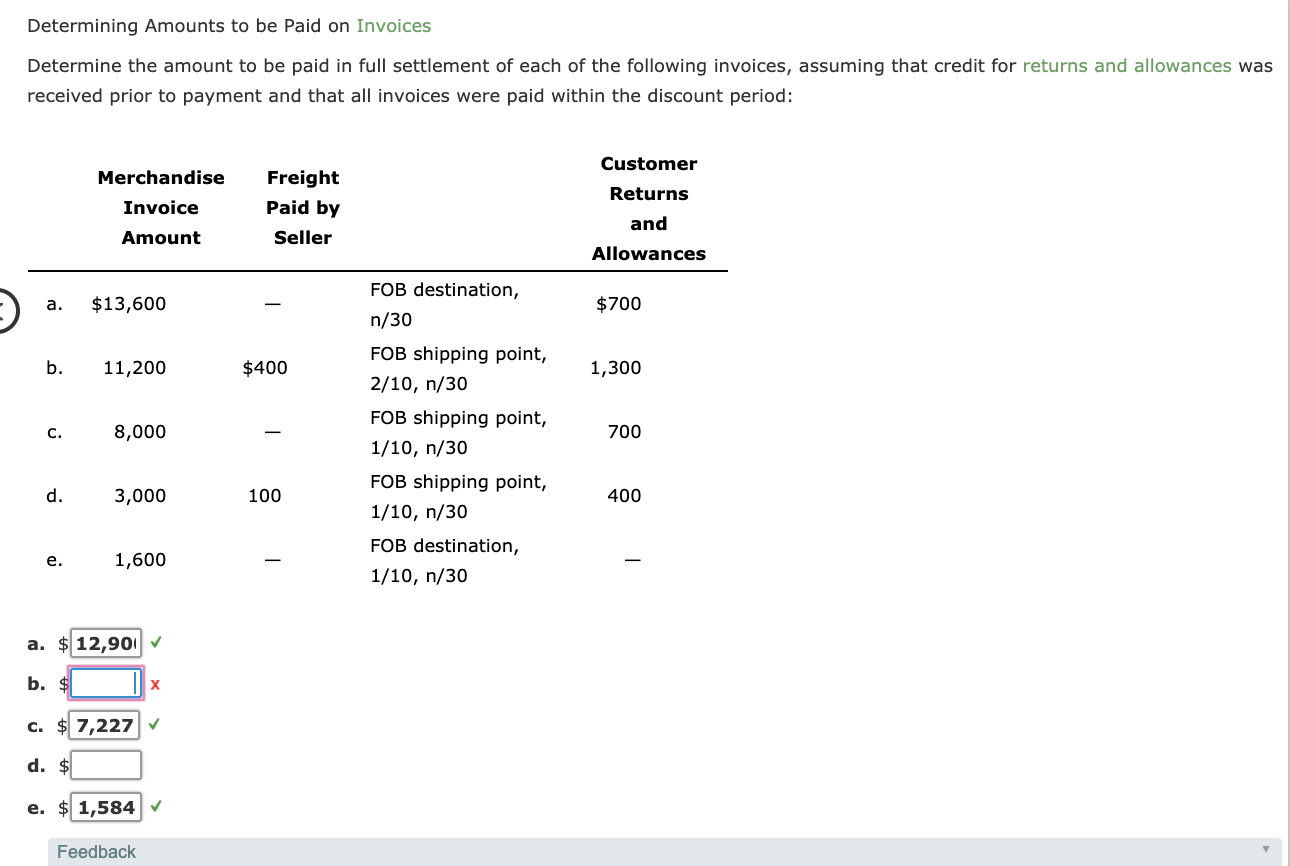

Can You Provide an Example of This Phrase in Action?

Consider a scenario where a company has three outstanding invoices totaling $10,000. If a client has a credit of $2,000 due to an earlier overpayment, the client can make a payment of $8,000 “in full settlement of each of the following invoices, assuming that credit.” This statement makes it clear that the payment covers all invoices while accounting for the credit.

What Should Be Included in an Invoice?

To ensure clarity and effectiveness, invoices should include:

- Invoice number and date.

- Detailed list of services or products provided.

- Individual amounts for each service or product.

- Any applicable taxes.

- Credits applied and the total amount due.

- Payment terms and methods accepted.

What Are the Benefits of Clear Invoicing Practices?

Adopting clear invoicing practices, including the use of phrases like “in full settlement of each of the following invoices, assuming that credit,” provides several benefits:

- Enhanced cash flow management.

- Improved client relationships through transparency.

- Reduced administrative errors and disputes.

How Can Technology Assist in Invoice Management?

With advancements in technology, businesses can streamline their invoicing processes through various tools and software. These technologies can help automate invoicing, track payments, and manage credits efficiently, leading to a more organized financial management system.

Conclusion: The Importance of Clarity in Financial Transactions

In conclusion, the phrase “in full settlement of each of the following invoices, assuming that credit” plays a significant role in ensuring clarity and transparency in financial transactions. By understanding its implications and effectively communicating through invoicing, businesses can foster better relationships, minimize disputes, and enhance their overall financial health. As the business landscape continues to evolve, adopting clear invoicing practices will remain paramount in navigating the complexities of financial transactions.

ncG1vNJzZmixn6PAtr7IZqWeq6RjsLC5jq2pnqaUnruogY6ipWaepaG5br%2FEraulnZ2au7V5zp9knpmTnXqwsoytn55llqS5rbvWoqWgZZmjw7C1wp6qZpmjqMKutc2gZK2gkal6pL7EnaCtZpipuq0%3D