Calculate? A. The Compound Interest B. The ROI Percentages C. The ROI Dollar

Understanding financial calculations is essential for making informed investment decisions. Whether you are a seasoned investor or just beginning to explore the world of finance, knowing how to calculate compound interest, ROI percentages, and ROI dollars can significantly impact your financial journey. These calculations not only help you assess the profitability of your investments but also guide you in comparing various financial opportunities.

In this article, we will delve into the intricacies of these essential calculations and provide you with the tools you need to take charge of your financial future. By gaining a solid understanding of how to calculate compound interest, ROI percentages, and ROI dollars, you can make more strategic investment decisions and ultimately achieve your financial goals.

So, are you ready to unlock the secrets of calculating compound interest, ROI percentages, and ROI dollars? Let’s dive into the world of financial mathematics and explore the nuances that can empower you to become a savvy investor.

What is Compound Interest?

Compound interest is the interest calculated on the initial principal and also on the accumulated interest from previous periods. It differs from simple interest, which is calculated only on the principal amount. Understanding how to calculate compound interest can help you maximize your earnings over time.

How Do You Calculate Compound Interest?

The formula for calculating compound interest is:

A = P (1 + r/n)^(nt)

- A = the future value of the investment/loan, including interest.

- P = the principal investment amount (initial deposit or loan amount).

- r = the annual interest rate (decimal).

- n = the number of times that interest is compounded per unit t.

- t = the time the money is invested or borrowed for, in years.

What Are the Benefits of Compound Interest?

- Increased earnings over time due to interest on interest.

- Encourages long-term investment strategies.

- Works best when compounded frequently.

What Are ROI Percentages?

Return on Investment (ROI) is a financial metric used to evaluate the efficiency of an investment. It measures the return relative to the investment’s cost, expressed as a percentage. Understanding ROI percentages is crucial for investors looking to assess the performance of their investments effectively.

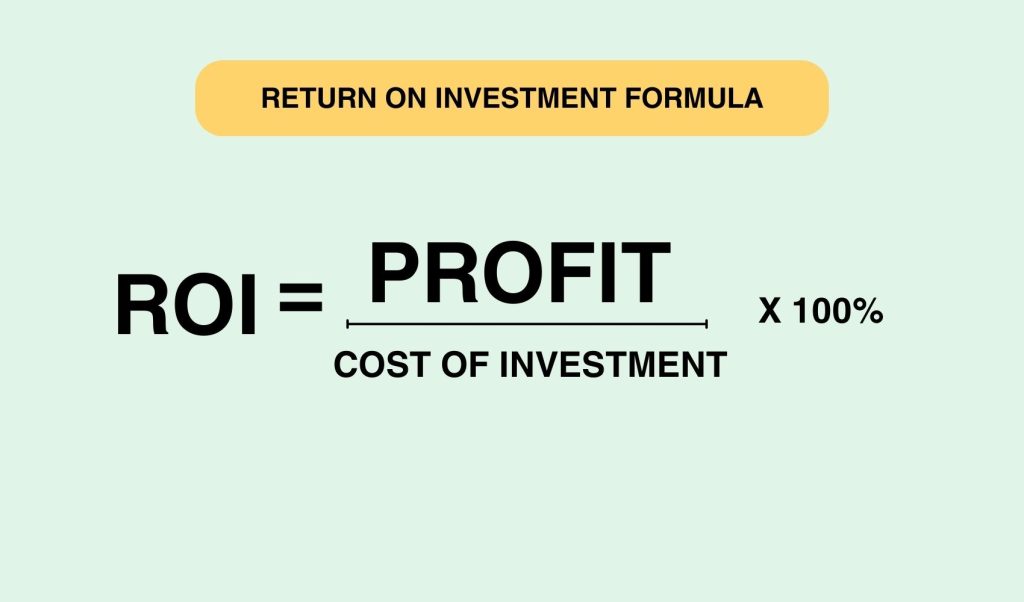

How Do You Calculate ROI Percentages?

The formula for calculating ROI is:

ROI = (Net Profit / Cost of Investment) x 100

- Net Profit = Total Revenue - Total Costs.

- Cost of Investment = The total amount invested.

What Are the Advantages of Using ROI Percentages?

- Allows for easy comparison between different investments.

- Helps identify the most profitable ventures.

- Assists in making informed financial decisions.

What is ROI Dollar Amount?

The ROI dollar amount refers to the actual monetary gain or loss resulting from an investment. It provides a clear picture of your financial performance without the need for percentage calculations. Knowing how to calculate the ROI dollar amount can help you gauge the success of your investments concretely.

How Do You Calculate ROI Dollar Amount?

The formula for calculating ROI dollar amount is:

ROI Dollar Amount = Total Revenue - Total Costs

- Total Revenue = The total money earned from the investment.

- Total Costs = The total amount spent on the investment.

What Are the Benefits of Understanding ROI Dollar Amount?

- Provides a straightforward assessment of financial gain or loss.

- Helps in budgeting and financial planning.

- Facilitates a more transparent overview of investment performance.

How Can You Apply These Calculations in Real Life?

Understanding how to calculate compound interest, ROI percentages, and ROI dollars is only the first step. The real challenge lies in applying these calculations effectively in your investment decisions. Here are some practical tips:

- Use online calculators to quickly compute compound interest and ROI.

- Keep detailed records of all your investments, including costs and revenues.

- Consider consulting with financial advisors for personalized advice.

Conclusion: Why is Financial Literacy Important?

In today's fast-paced financial world, being able to calculate? A. The compound interest B. The ROI percentages C. The ROI dollar is essential for making informed decisions. Mastering these calculations can empower you to navigate the complexities of investing with confidence. Remember, the key to successful investing lies not just in knowing the numbers, but in understanding their implications for your financial future.

ncG1vNJzZmixn6PAtr7IZqWeq6RjsLC5jq2pnqaUnruogY6cmKWbpaGutbHArZ%2BeZZOkurG71KebZqGeqbKzsdKtma2glWK%2FsLWMqZyrm5WjwaKzxKyaraCVYr%2BwtYydpqWkkad7qcDMpQ%3D%3D